Swing

While I was attempting to decipher James Montier's, "In Defence of Old Ways", (not a knock on Montier, just a comment on my stupidity) it struck me - there's usually two ways brick pushers respond to figures showing Oprah's favourite country is in a real estate bubble.

Either they acknowledge them, then fiddle them, to suit their own ends - hello Commonwealth Bank. Or they dismiss them entirely, as being outdated methods of measurement, to suit their own ends - hello ANZ.

So, it's either dubious fudging, or we're in a new paradigm. And if we're in a new paradigm, are we really in a new paradigm? As Montier points out:

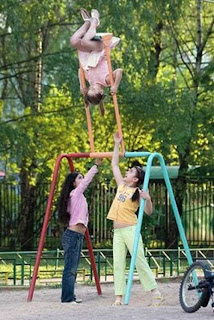

It is also worth noting that in order for mean-reversion-based strategies to work, it is not required that the mean be realized for long periods of time, but that markets continue to behave as they always have, swinging pendulum like between the depths of despair and irrational exuberance, or, from risk-on to risk-off.Kind of like this swinging pendulum in Burnie.

Sure you can't see much from the front, but when this 4x1 first listed back in September 2010 for $325,000, someone thought the pendulum had got stuck waaaaaaay out there. By November a wrecking ball was bearing down fast and those dreams of "early to mid 300's" had been paid a visit by Freddy Krueger - the price was slashed to $285,000, and if you pushed, they might even toss in that Lancer.

Eventually the joint sold for $277,000 - almost exactly three years to the day after selling for $255,000 in 2007. Yeah that's still a gain and the most ardent spruiker will tell you so, but what of that big discount - "oh they were just seeing if they could snag a sucker with that first price."

Well they could have snagged him - eleven months earlier. Same street, a few doors up, some space monkey paid $289,000 for a 2x1. See what I mean about that pendulum swinging back? Had the chimp in the NASA suit taken a de-contamination shower, chilled out and smoked a few banana skins, he would have had an extra two bedrooms to invite his monkey friends over on the weekend - and saved $12,000.

That would have bought a lot of bananas.

Eleven months was the difference between paying over the odds for one buyer and not getting the expected price for one seller. Think we've see the last of it?

Nope - because there's more lessons to be learnt on the benefits of time and how you'll never be "priced out forever." With the Burnie unit median pushing into the mid $200's over the past few years, it must have seemed like a perfect time to drop a unit onto the market and take advantage of those juicy capital gains.

This unit was all yours for $235,000 back in February last year, but what would have happened if you waited? Give or take 3-4 discounts across 2010, it was down to $179,990 by December. And if that wasn't enough, the hopefully final (for the vendor) act of discounting frustration happened this week. Another hefty slash signalling, "if you don't buy it, I may have to burn it", this unit hit $160,000.

Last sale price? $150,000 in 2004. And the bad times haven't even begun.

While some have endured a real world experience in the swinging pendulum of real estate, others are blissfully unaware of the wet beach towel about to flick them in the gonads.

This is a one in a million shot if it ever existed. A 3x1 currently asking $325,000, now if you're not yet convinced to purchase, wait until you see this one shake its money maker. Back in July 2010 this one was snapped up for $290,000. There's no mistake here, it was in the owner's possession for a whole five months before going back on the market.

If it's not obvious, this house is appreciating at $5,000 a month and it's almost unforgivable, being on the market 27 days, that the agent hasn't updated the price to $330,000.

Some people know it, others are experiencing it, and the rest?

"Weeeeeeeeeeeeeeeeeeeee!"

Comments

Post a Comment